Orchestrating Multi-Party Investment Execution

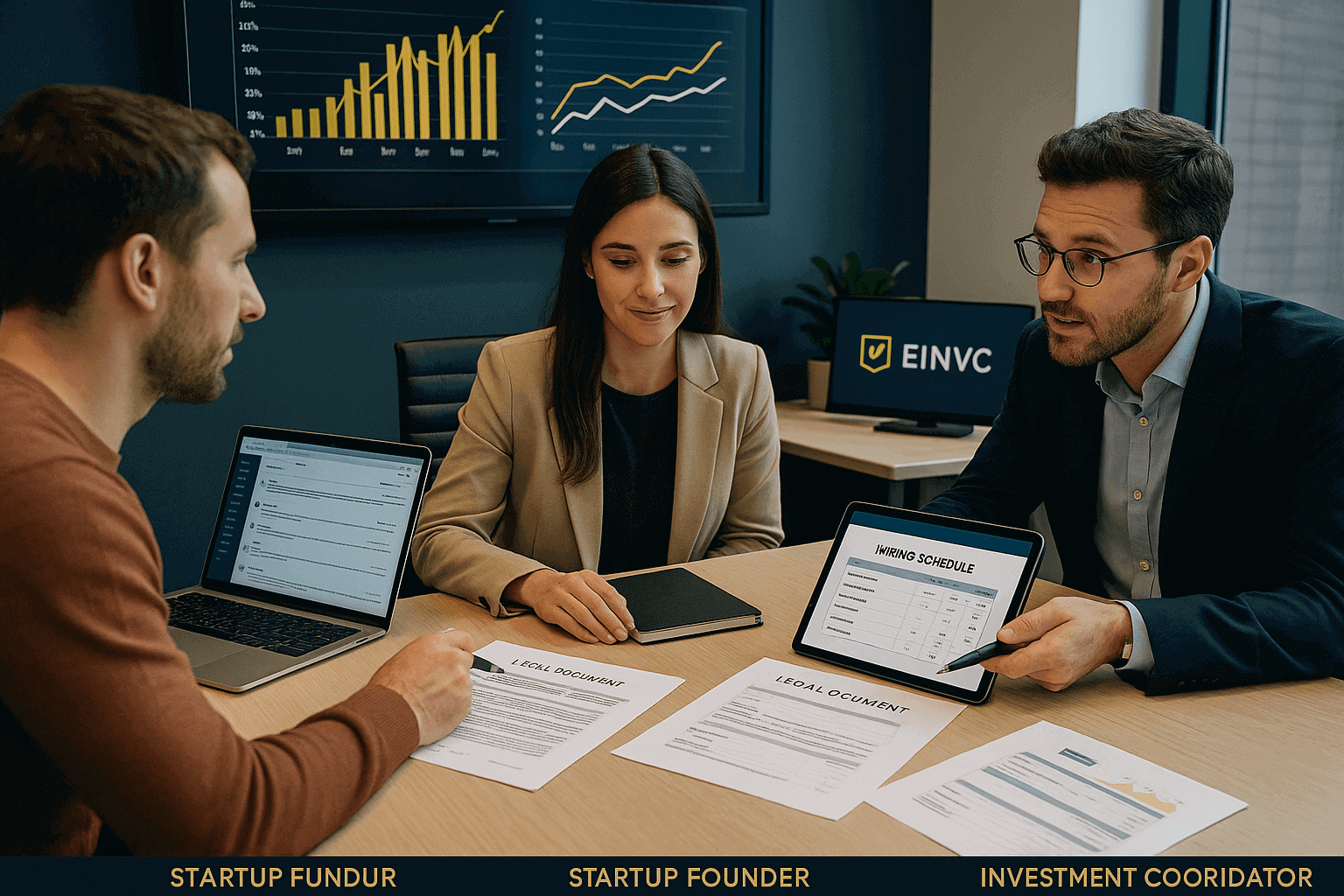

Capital Investment Coordination by EIN Venture Capital (EINVC) ensures that investor commitments are turned into clean, timely capital execution. We synchronize legal documentation, banking compliance, investor onboarding, and founder readiness across all stakeholders.

Our smart deal matching leads to multi-party term sheets. We manage the moving pieces — investor timelines, signature cycles, escrow releases, capital tranches — so nothing falls through during the critical execution window.

From cap table updates to final subscription agreements, our Success Managers ensure all legal, financial, and operational inputs are locked — leaving founders free to lead, not chase paperwork.

We coordinate complex capital deployment — from signatures to escrow, ensuring aligned execution across investor groups and legal tracks.

Request Capital SupportA deal signed is not a deal closed. Without precise coordination, funding timelines slip and investor confidence erodes. EINVC ensures every moving part clicks.

Our team serves as the capital conductor — aligning documentation, timing, and investor expectations so that capital moves with precision and trust.

Whether you're raising funds or seeking investment-ready deals, EINVC helps connect you to the right capital at the right time.

Whether you're fundraising or investing in high-impact ventures, EINVC helps you act with clarity, speed, and strategy.